JNews has been reporting on the danger of rampant inflation for last 3 months. Reports coming in confirm this to be true. Things will get worse as the strength of the dollar will plummet as a result of the massive inflation and debt being imposed upon this country by the Biden (OBAMA) administration.

THOMAS CATENACCI

May 04, 20218:26 PM

- Consumer prices in the U.S. have skyrocketed across multiple industries as the federal government mulls injecting further stimulus into the economy.

- “We are seeing very substantial inflation,” Warren Buffett, billionaire investor and chairman of Berkshire Hathaway, said at his company’s annual shareholder meeting Saturday, according to CNBC.

- “The 100% cause of inflation is the government,” Peter Schiff, the chief economist and global strategist of Euro Pacific Capital, told the Daily Caller News Foundation. “It’s when the government spends money that it doesn’t collect in taxes.”

Consumer prices in the U.S. have skyrocketed across multiple industries as the federal government mulls injecting further stimulus into the economy.

The consumer price index spiked 0.6% in March, the largest monthly increase in nearly a decade, the Labor Department reported last month. In particular, the costs of lumber, gasoline, steel, copper, computer chips, homes and home appliances have all substantially increased in the past few months.

“We are seeing very substantial inflation,” Warren Buffett, billionaire investor and chairman of Berkshire Hathaway, said at his company’s annual shareholder meeting Saturday, according to CNBC. “It’s very interesting. We are raising prices.”

“The costs are just up, up, up,” he continued. “Steel costs, you know, just every day they’re going up.” (RELATED: Democrats’ Massive Stimulus Isn’t Likely To Wreck The Economy, Experts Say)

Lumber prices hit an all-time record price of $1,500.50 per thousand board feet on Friday, according to The Wall Street Journal. The high cost of wood is expected to stay elevated for several months.

The high cost of wood has contributed to the rising cost of homes nationwide. Home prices rose 11.3% in March, the largest increase since 2006, real estate insights firm CoreLogic reported Tuesday.

Buffett noted that the cost of building homes is increasing due to lumber and steel price increases, CNBC reported. Berkshire Hathaway owns Clayton Homes, one of the largest homebuilding companies in the U.S, paint maker Benjamin Moore and carpet manufacturer Shaw Industries.

“Homebuyers are experiencing the most competitive housing market we’ve seen since the Great Recession,” Frank Martell, president and CEO of CoreLogic, said in a statement last month. “Rising mortgage rates and severe supply constraints are pushing already-overheated home prices out of reach for some prospective buyers.”

In the first quarter of 2021, new car sales increased 8.4% compared to the same period last year, according to J.D. Power, CNN reported. Auctioned used cars have increased in price 26% since the beginning of the year.

The average price of gasoline has risen with crude oil prices, according to the Energy Information Administration. The national average price of retail gasoline reached $2.89 per gallon on Monday, up more than $1 per gallon compared to one year ago.

Gas prices over $4 per gallon are displayed at a Chevron gas station on March 3 in Mill Valley, California. (Justin Sullivan/Getty Images)

More Inflation To Come, Experts Say

Economists said rising prices are just the beginning. Recent trillion-dollar spending packages signed into law will contribute to additional inflation, they added.

“We’re going to see massive inflation,” Peter Schiff, the chief economist and global strategist of Euro Pacific Capital, told the Daily Caller News Foundation in an interview.

“People are going to be paying higher insurance, they’re going to be paying higher property taxes, local tax, utility rates are going to go way up, maintenance costs,” Schiff continued. “Americans are going to see a big drop in their standard of living, a very substantial drop.”

Lawrence Summers, who previously led the Treasury Department and the National Economic Council, said he is concerned about inflation even as the economy recovers from the coronavirus pandemic in an interview with Bloomberg on Sunday. The labor shortage will contribute to higher inflation rates.

Before Democrats passed the $1.9 trillion coronavirus relief package, Summers warned that such stimulus would spark inflation “of a kind we have not seen in a generation.”

House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer hold the signed American Rescue Plan Act on March 10. (Olivier Douliery/AFP via Getty Images)

Summers and Schiff, who also pointed to the labor shortage as a factor in projected inflation, agreed that government spending will contribute to further price increases.

“The 100% cause of inflation is the government,” Schiff told the DCNF. “It’s when the government spends money that it doesn’t collect in taxes and then the Federal Reserve monetizes the resulting deficits by printing money.”

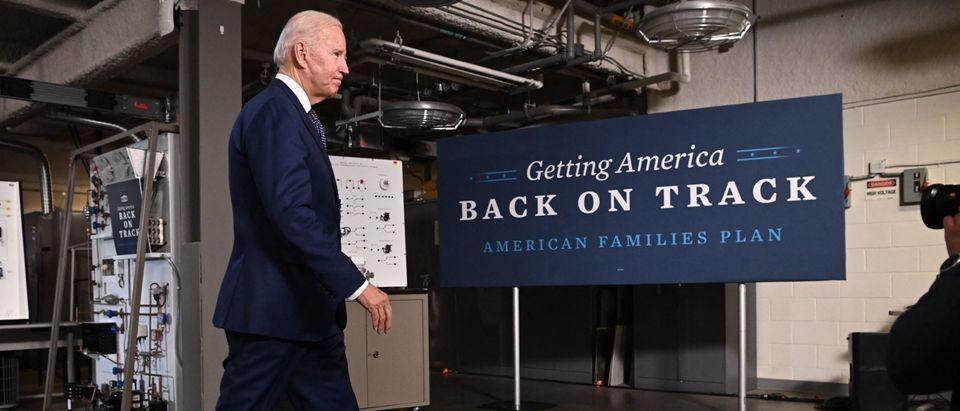

President Joe Biden proposed a $2 trillion infrastructure plan and a $1.8 trillion plan to boost several welfare programs. In March, the U.S. recorded its third-largest monthly budget deficit ever when the government spent $927 billion and reported revenue of $268 billion. (RELATED: ‘Disastrous Impact’: Small Business Advocates Criticize Biden’s First 100 Days)

“Every dollar the government spends is the equivalent of a tax, because every dollar the government spends, the money has to come from the American people,” Schiff said. “Some of that money comes from higher taxes on the rich, the rest of it is coming from the inflation tax that’s going to hit the poor and the middle class much harder than it will the rich.”

Schiff said government causing inflation and higher prices across the board amounts to an “inflation tax,” or an indirect tax on regular Americans.